Choosing between online and traditional learning can feel like navigating a maze, right? You're juggling tuition fees, textbooks, and maybe even accommodation costs, all while trying to figure out which path offers the best return on investment. The truth is, understanding Comparing the Cost of Online vs Traditional Learning requires a deep dive into various factors beyond just the sticker price – think hidden fees, lifestyle adjustments, and long-term career prospects.

We're going to untangle the financial web surrounding both online and traditional learning environments, exploring direct costs like tuition and materials and indirect expenses such as commuting and childcare. This comparison also considers the potential for scholarships, grants, and other forms of financial aid, as well as the income you might forego while studying. This exploration will also help you determine which learning environment is more suitable for your financial situation and your academic and professional goals.

This article aims to provide a comprehensive overview of Comparing the Cost of Online vs Traditional Learning , breaking down the financial implications of each option. We’ll examine tuition fees, learning materials, accommodation, transportation, and technology requirements. Additionally, we’ll delve into the potential for financial aid, scholarships, and tax benefits. By considering all these factors, you'll be well-equipped to make an informed decision about your education.

Ultimately, understanding the true cost of your education is crucial for making a smart investment in your future. Comparing the Cost of Online vs Traditional Learning involves careful consideration of both direct and indirect expenses, potential financial aid, and the long-term value of the education you receive. This exploration should empower you to confidently choose the path that aligns best with your financial capabilities and aspirations.

Online vs. Traditional Learning: A Head-to-Head Cost Comparison

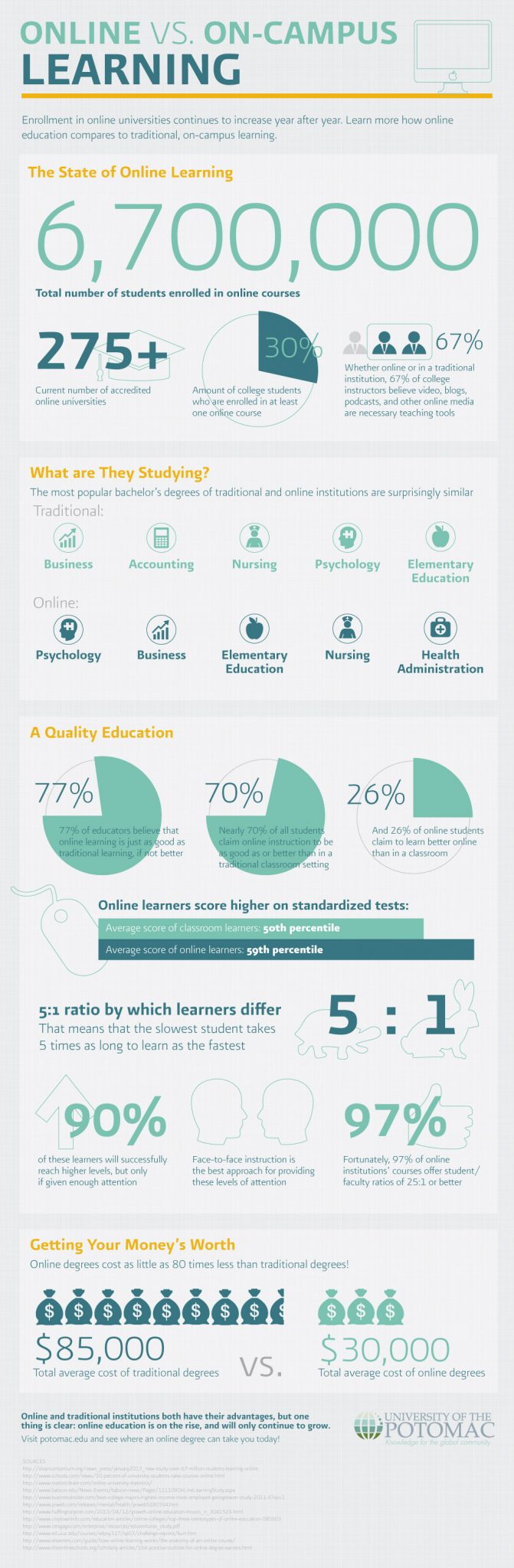

It's not always a simple matter of "online is cheaper." Sometimes, that's totally true! But other times, traditional learning might surprise you with its affordability. Let's break down the different areas where costs can stack up.

Tuition Fees: The Big Kahuna

Alright, let's get the obvious one out of the way. Tuition fees are usually the biggest chunk of change when you're talking about education costs.

Traditional Universities: These can range from surprisingly affordable (think state schools and community colleges) to "whoa, that's a lot of money!" (private universities and specialized programs). You're often paying for the prestige, the campus facilities (gyms, libraries, fancy cafeterias), and the in-person experience.

Online Programs: Usually, online programs boast lower tuition fees. They don't have to maintain massive campuses or as many on-site staff. But, don't assume all online programs are cheap! Some prestigious online courses from well-known universities can still carry a hefty price tag. Do your research and compare!

Hidden Costs: The Sneaky Expenses

This is where things get interesting, and where online learning can really shine. Think about all the things you don't have to pay for when you're learning from your couch.

Accommodation: Living in a dorm or renting an apartment near campus is a major expense. Online learning eliminates this completely! That's huge savings right there.

Transportation: Gas, parking permits, bus passes… it all adds up. Online learning means zero commute. You can spend that time (and money!) on something way more fun.

Meal Plans: Those campus cafeterias are convenient, but they're not cheap. Cooking your own meals at home is usually much more budget-friendly.

Childcare: If you're a parent, juggling classes with childcare can be a nightmare (and a huge financial burden). Online learning offers more flexibility, allowing you to study around your family's schedule.

Learning Materials: Textbooks and Tech

Okay, so you might think textbooks are textbooks, right? Not quite!

Traditional Learning: Textbooks can be ridiculously expensive. Plus, you might need specific software or equipment for certain courses.

Online Learning: Many online programs use e-books or provide digital resources, which can be cheaper than physical textbooks. However, you will need a reliable computer and internet connection. If you don't already have those, factor those costs in.

The Opportunity Cost: Time is Money

This is a big one that people often overlook. "Opportunity cost" basically means the money you could be earning if you weren't in school.

Traditional Learning: The structured schedule of traditional classes can make it harder to work full-time. You might have to cut back your hours or take a lower-paying job.

Online Learning: The flexibility of online learning allows you to work around your studies. You might even be able to continue working full-time, which is a huge financial advantage.

Unlocking Financial Aid and Savings

Don't assume you're on your own when it comes to paying for school. There are tons of resources out there!

Scholarships and Grants: Free Money!

Do your research! There are scholarships and grants for pretty much everyone, regardless of whether you're studying online or in person. Look for opportunities based on your academic achievements, your background, or even your intended field of study. Websites like Scholarships.com and Fastweb are great places to start.

Don't be afraid to apply! Even if you don't think you're a "perfect" candidate, it's worth a shot. You never know what might happen.

Tax Benefits: Uncle Sam Can Help

The American Opportunity Tax Credit and the Lifetime Learning Credit can help offset the cost of education. Talk to a tax professional to see if you qualify.

Keep track of your expenses! You might be able to deduct certain education-related expenses on your taxes.

Employer Tuition Assistance: Get Your Company to Pay

Many companies offer tuition assistance programs to help employees further their education. Check with your HR department to see if this is an option for you. This can be a huge benefit, especially if you're looking to advance your career within your current company.

Community College: A Smart Starting Point

Consider starting at a community college and then transferring to a four-year university. Community colleges usually have much lower tuition fees. You can get your general education requirements out of the way at a fraction of the cost.

Making the Right Choice for You

So, which is cheaper: online or traditional learning? The answer, as you've probably guessed, is "it depends."

If you're looking to minimize upfront costs and maximize flexibility, online learning is often the way to go.

If you value the in-person experience and don't mind paying a bit more for it, traditional learning might be a better fit.

Consider your learning style. Some people thrive in a structured classroom environment, while others prefer the self-paced nature of online learning.

Think about your career goals. Some fields require a traditional degree, while others are perfectly fine with online credentials.

Factors to Consider Beyond Cost

Cost is important, no doubt. But don't let it be the only factor you consider. Think about:

Accreditation: Make sure the program you choose is accredited. Accreditation ensures that the program meets certain quality standards.

Reputation: Research the reputation of the institution or program. Read reviews and talk to alumni.

Support Services: Does the program offer adequate support services, such as tutoring, career counseling, and technical assistance?

Networking Opportunities: Will you have opportunities to network with other students and professionals in your field?

Real-Life Examples: Online vs. Traditional

Scenario 1: Maria, a working mom: Maria wants to get a bachelor's degree in accounting, but she has a full-time job and two young children. Online learning is the perfect solution for her. She can study at her own pace, around her family's schedule, and avoid the costs of childcare and commuting.

Scenario 2: David, a recent high school graduate: David wants to become a doctor. He values the in-person experience of traditional learning and wants to attend a prestigious university with a strong pre-med program. He's willing to take out student loans to finance his education.

Scenario 3: Sarah, a career changer: Sarah wants to switch careers from marketing to data science. She already has a bachelor's degree, so she doesn't need a full degree program. She decides to enroll in an online bootcamp to learn the skills she needs to get a job in her new field. This is a much faster and cheaper option than going back to school for another degree.

FAQ: Your Burning Questions Answered

Alright, let's tackle some of those questions that are probably swirling around in your head.

Online Learning FAQs

Q: Is online learning really as good as traditional learning?

A: It can be! The quality of online programs varies widely. Look for accredited programs with experienced instructors and a strong track record. The key is to be self-motivated and disciplined. Comparing the Cost of Online vs Traditional Learning also involves comparing the quality and reputation of the specific programs you're considering.

Q: Will employers take my online degree seriously?

A: Increasingly, yes. As online learning becomes more mainstream, employers are recognizing the value of online degrees. However, it's important to choose a reputable program from an accredited institution.

Q: What kind of technology do I need for online learning?

A: At a minimum, you'll need a reliable computer, internet connection, and webcam. Some programs may require specific software or equipment.

Q: How do I stay motivated when learning online?

A: Set realistic goals, create a study schedule, and find a study buddy. Join online forums and connect with other students. Reward yourself for your accomplishments.

Traditional Learning FAQs

Q: Is a traditional degree worth the investment?

A: For many people, yes. A traditional degree can open doors to better job opportunities and higher earning potential. However, it's important to consider the cost of tuition, living expenses, and lost income.

Q: How do I choose the right college or university?

A: Consider your academic interests, career goals, and budget. Visit campuses, talk to current students, and research the program's reputation.

Q: What if I can't afford to go to college?

A: Don't give up! There are many financial aid options available, including scholarships, grants, and student loans. Consider starting at a community college and then transferring to a four-year university.

Q: How do I balance school with work and other responsibilities?

A: Time management is key! Create a schedule, prioritize your tasks, and don't be afraid to ask for help.

General Cost FAQs

Q: What are some often-overlooked costs of education?

A: Think about things like childcare, transportation, textbooks, software, and exam fees.

Q: How can I save money on textbooks?

A: Buy used textbooks, rent textbooks, or look for e-books.

Q: Are there any tax benefits for education expenses?

A: Yes, the American Opportunity Tax Credit and the Lifetime Learning Credit can help offset the cost of education.

Q: Is it worth taking out student loans to pay for school?

A: That's a personal decision. Consider your future earning potential and your ability to repay the loans.

Conclusion: Making the Informed Decision

Choosing between online and traditional learning isn't just about comparing price tags; it's about aligning your educational path with your lifestyle, learning style, and career aspirations. The process of Comparing the Cost of Online vs Traditional Learning can feel overwhelming, but by breaking down the expenses, exploring financial aid options, and considering the long-term benefits, you can make a confident decision. Whether you opt for the flexibility and affordability of online learning or the immersive experience of a traditional campus, remember that investing in your education is an investment in your future. Choose wisely, and good luck!